It’s the best month of the year! No more hiding from your finances or pushing your money issues aside.

November is Financial Literacy month and to support you we’ve put together a group of speakers who will help educate you on how to improve your personal financial management and, in general, make better financial decisions.

… and, it’s completely free! Registration links are below.

. . .

The Next 100k with Cat Stancik

November 1 @ 10 a.m. (1 hour)

REGISTER HERE

Identify the best time-saving strategies to help generate more leads (in an hour or less a day.)

Cat Stancik, is a marketing strategist who supports expert professional service providers to create firework experiences that attract ideal clients into one place that spark conversations that lead to more sales.

In this session, you’ll learn how to:

- Identify the best time-saving strategies to help generate more leads (in an hour or less a day)

- How to add $100k without adding more work to your day

- What you can do to have more of your clients reach out to you (no chasing!)

. . .

Soul Sales: A Radical Approach to Selling from INSIDE your Comfort Zone with Lisa Dadd

November 8 @ 10 a.m. (1 hour)

REGISTER HERE

Let’s rediscover that innate part of you that supersedes you from having to “sell” anything, and feels as natural as chatting with a friend.

Lisa Dadd is an expert sales trainer, business leader, and former Ted X speaker. She believes in the vision of a world where each and every woman learns her worth and knows how to show up in it – generously and unapologetically!

Whether you are selling a product, a service, or an idea, we all “sell” at some point. Each and every one of us is the most enrolling when we are being fully ourselves. Beyond simply “being authentic,” knowing how to show up and put language around this, helps others differentiate what we have to offer, and greatly impacts our ability to build relationships and create impact.

. . .

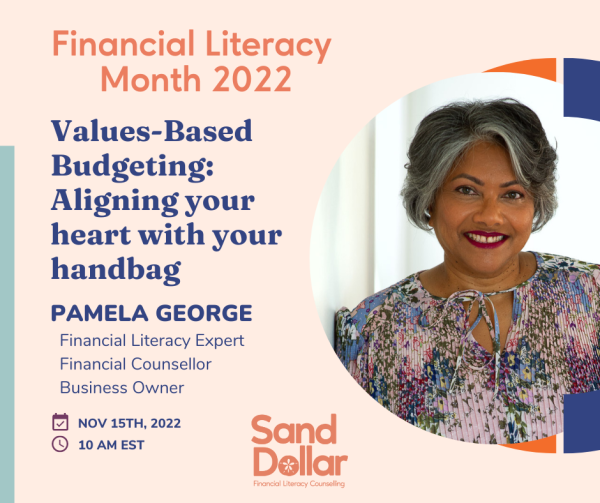

Values-Based Budgeting: Aligning your heart with your handbag

November 15 @ 10 a.m. (1 hour)

REGISTER HERE

This is a working webinar! You’ll spend the hour figuring out your values and then discuss how you can ensure that those values are reflected in your budget.

Pamela believes every woman deserves to be aware of her relationship with money, confident in her abilities to manage her finances and be self-sufficient in her approach. She has successfully helped hundreds of women balance their budgets, address their financial trauma, and save for the future so they can start living the life they really want to live.

This is a working webinar! So come prepared with a couple of sheets of paper, a pen, pencils, and some highlighters. You’ll spend the hour figuring out your values and then we’ll discuss how you can ensure that those values are reflected in your budget.

. . .

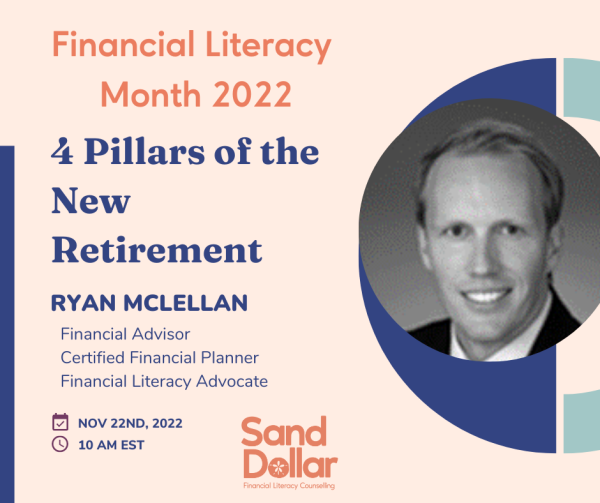

4 Pillars of the New Retirement with Ryan McLellan

November 22 @ 10 a.m. (1 hour)

REGISTER HERE

The four pillars of the new retirement are health, family, purpose, and finances; inextricably interconnected, and each is essential to thriving in the new retirement.

Ryan is passionate about having his clients feel heard. He works closely with retirees to find out what is important to them, identifying goals and a comfort level with risk before putting together a tailored investment strategy that focuses on them and the 4 pillars of the new retirement.

The New Retirement no longer means the end of work, but rather having greater freedom to choose whether and how much one wants to work. It is becoming an exciting and fulfilling stage of life—full of new choices, new freedoms, and new challenges. Some retirees may still see retirement as a time for rest and relaxation, but the majority call it “a whole new chapter of life.”

. . .

Mental Health, Finances & Well-Being with Julia Sage

November 29 @ 10 a.m. (1 hour)

REGISTER HERE

In this workshop, we will explore the links between financial health and mental well-being.

Julia Sage is a registered social worker, and psychotherapist who currently works in private practice where she supports adults to reclaim their lives from anxiety. Prior to opening her practice, Julia worked in various roles supporting folks with their mental health including the Ontario Structured Psychotherapy program which aims to offer helpful and accessible mental health care.

We tend to see money and mental health as totally separate issues but spoiler alert: they are not! Julia will talk about her own journey with financial challenges and how taking steps to deal with these meant leaning in towards her fear (hello, shame & vulnerability) but also helped to shift her beliefs and relationship with money, ultimately allowing her to have a life that feels more in line with her core values. We will talk about some steps you can take to transform your relationship with money.

. . .

Have any questions about these sessions? Send me an email – [email protected].